Massachusetts HIRD Filing

Massachusetts HIRD form filing

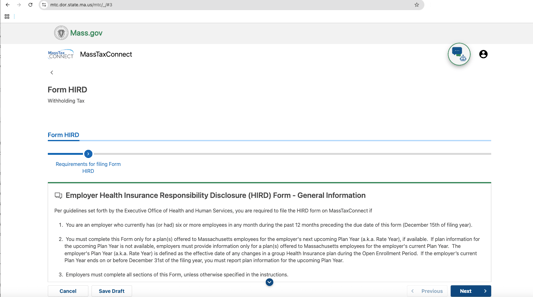

Massachusetts employers have until December 15th to complete the MA HIRD form. State law requires every employer in Massachusetts with six or more employees to annually submit a HIRD form.

About the HIRD requirement

The Health Insurance Responsibility Disclosure (HIRD) form is a state reporting requirement in MA. It has been in place since 2018.

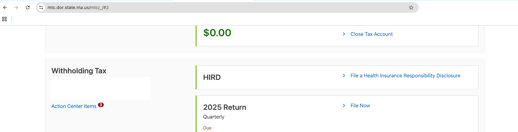

The form is accessible through the Department of Revenue's MassTax Connect online portal.

Click this link for instructions on how to log into your MassTax Connect account.

The eligibility and plan information on the form allows MA Administration to identify employees who are enrolled in MassHealth but could be enrolled in their employer-sponsored insurance with support from the Premium Assistance Program. This will help some employers avoid the EMAC Supplement tax, while still ensuring insurance coverage for employees.

HIRD and ICHRA

Regardless of where your company is located, if you have six or more employees who were employed in the state of Massachusetts during the past 12 months, your company is required to complete the HIRD form.

If your company changed from group benefits to ICHRA mid-year, you only need to complete one HIRD form based on whatever benefits are currently active.

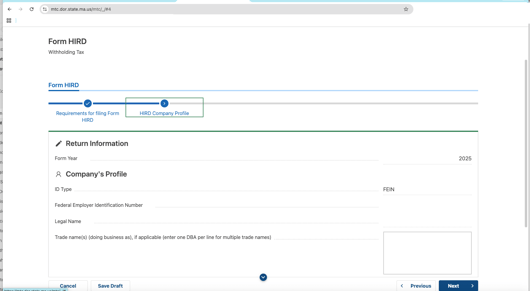

Filling out your HIRD form

- The form is accessible through the Department of Revenue's MassTax Connect online portal. Click this link for instructions on how to log into your MassTax Connect account.

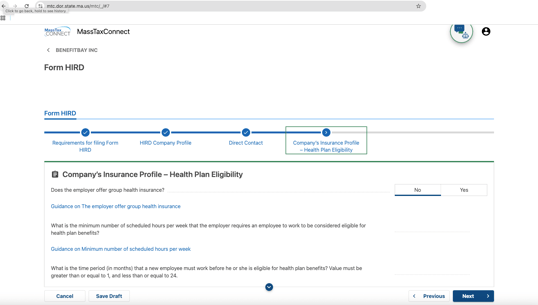

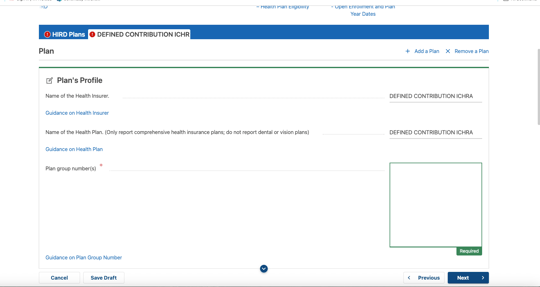

- Select "NO" under the question "Company Insurance Profile - Does the Employer offer group health insurance?"

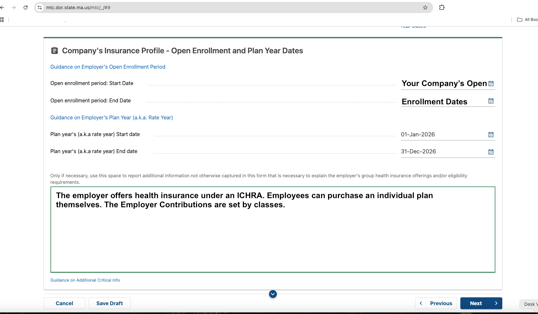

- Use the space where additional information can be provided to indicate: "The employer offers health insurance under an ICHRA. Employees can purchase an individual plan themselves. The Employer Contributions are set by classes."

- List the eligibility status and contribution amounts by class. You do not need to do it for each employee

- HIRD states that employers do not need to report on HRAs, FSAs, and HSAs, but employers offering ICHRA should still submit HIRD forms to report on offered contribution amounts.

Filling out the HIRD Form: Images

![branded_update_bb_logo_r_230728-2.png]](https://knowledge.benefitbay.com/hs-fs/hubfs/branded_update_bb_logo_r_230728-2.png?width=234&height=70&name=branded_update_bb_logo_r_230728-2.png)