Payroll Deduction Report

How to access and understand the Payroll Deduction Report.

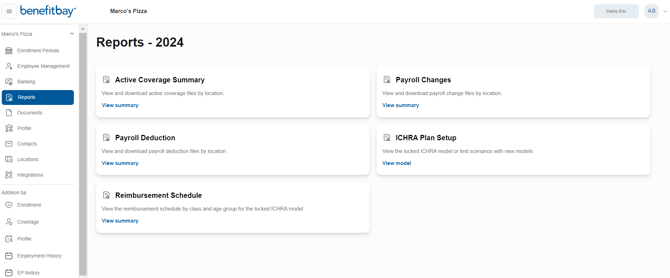

How to access the Payroll Deduction Report:

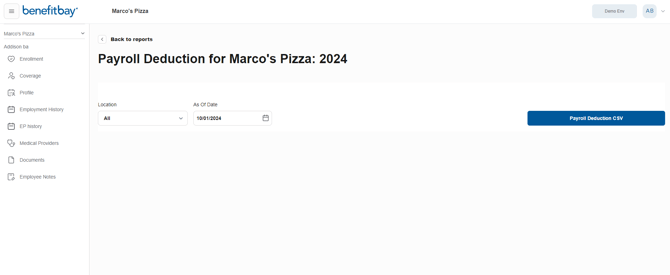

If there are any open enrollment periods for your company, these details will not show on the report until after the enrollment is closed.

- Login to benefitbay and select the "Reports" tab on the left navigation bar under your company's name

- Select the in the "Payroll Deduction" option

- You can choose to filter by location if your company uses worksite locations. In addition, you can change the date to the next month.

You should change the date to the first day of the next month, as that is when the coverage starts (ex. December 14, move dated to January 1). This will ensure you capture all the company changes; new hires, terminations, and qualifying life events as long as the enrollment period has been closed.

- Once you have the choices set to your preference, click the blue "Payroll Deduction CSV" on the right side of the screen.

- You will see a download is added or opened on your computer.

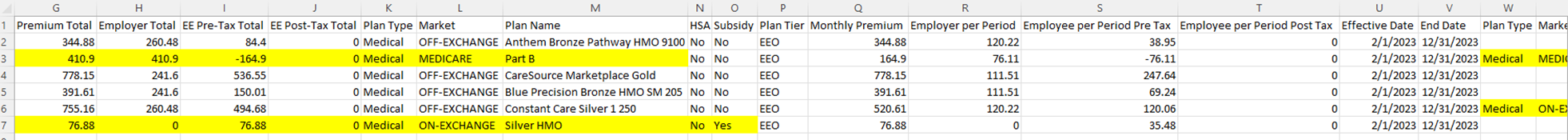

How to understand the Payroll Deduction Report:

Data Details:

- Personal Information (not pictured) - This will be located to the left of the report; such as name, date of birth, etc.

- Monthly Premium - This will be located at the beginning of the report (columns E-H).

- Per Paycheck Information - This will be located toward the end behind the plan information (columns N-Q).

- Effective Date - This is the month coverage will start (column N).

If an employee has more than one plan (common with out-of-state dependants and Medicare), each plan's details, deductions, and effective date will be listed separately (columns M and on).

Payroll Details:

- Per Pay Period - This calculation is based on the payroll frequency selected by your company.

- Pre-Tax Amounts - This is determined if the employee bought a plan "off-exchange" or directly through an insurance carrier.

- Post-Tax Amounts - This is determined if the employee bought a plan "on-exchange" and typically utilized a tax credit (subsidy).

- Medicare Amounts - This amount may reflect a negative number, which means the employee is paying a portion directly from their Social Security check, therefore the employer is utilizing the ICHRA contribution to reimburse the employee.

- Medicare reimbursements are Pre-Tax and should NOT increase the employee's taxable income.

Employees may utilize the ICHRA contribution offered by their employer OR the tax credit (subsidy), but not both!

![branded_update_bb_logo_r_230728-2.png]](https://knowledge.benefitbay.com/hs-fs/hubfs/branded_update_bb_logo_r_230728-2.png?width=234&height=70&name=branded_update_bb_logo_r_230728-2.png)