Bronze, Silver, Gold, and Platinum Metal Tiers

The difference between the metal tiers for insurance plans.

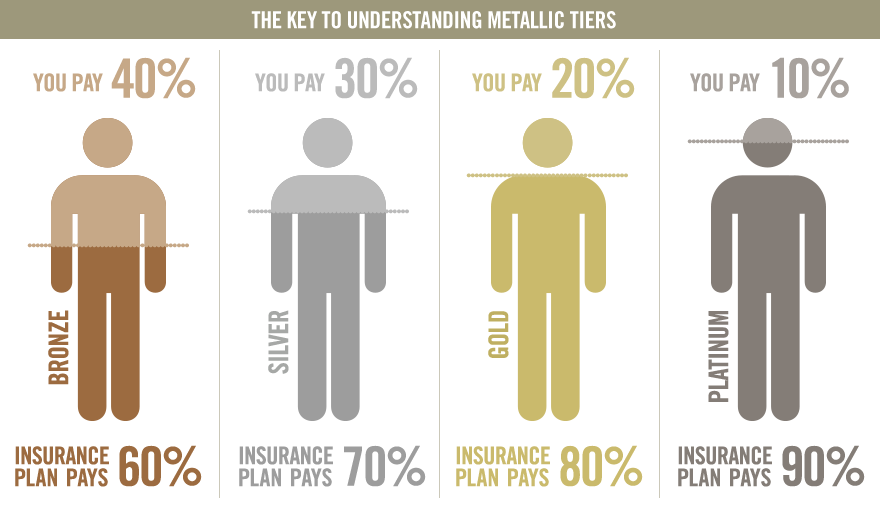

ICHRA Medical Plans are identified as Bronze, Silver, Gold, and Platinum Metal Tiers. These metal tiers differentiate each plan and determine how you and your insurance carrier will share the medical costs for your health care. They have nothing to do with the quality of care you will receive.

Differences Between Metal Tiers

Bronze Plans have the lowest monthly premiums when compared to the other plan levels. These plans pay approximately 60% of an individual’s covered medical costs. Bronze Plans typically have high deductibles and many of them qualify as high-deductible health plans (HDHPs). HDHPs have lower premiums but require you to pay higher deductibles before your insurance carrier starts to pay its share. With their low premiums, Bronze Plans can be a good cost-saving option for people who are relatively healthy and do not require frequent visits to a doctor, prescription medications, or other healthcare services.

Silver Plans pay approximately 70% of an individual’s covered medical costs. The Silver Plans have slightly higher premiums but lower deductibles than Bronze Plans. Consequently, Silver Plans do not qualify as high-deductible health plans (HDHPs). With lower deductibles, you will pay less in out-of-pocket expenses to meet your deductible prompting your insurance carrier to begin paying its share of your medical expenses faster.

Gold Plans pay approximately 80% of an individual’s covered medical costs. Compared to Silver Plans, the Gold Plans have a higher monthly premium but don’t require you to pay as much toward a deductible before your insurance carrier begins paying its share of your medical expenses. This plan can be a good option if you are going to have expensive medical needs throughout the year that the plan covers, which will allow you to easily reach your deductible.

Platinum Plans pay approximately 90% of an individual’s covered medical costs. Platinum plans usually have the highest monthly premiums of any plan category but pay the most when you get medical care. They can be good for people who need to visit the doctor often, take multiple medications, and are worried about high out-of-pocket healthcare costs.

Once you have determined your consumer preference regarding costs, you can access the ICHRA Marketplace through the benefitbay® platform. There, you can review details about the specific plans and choose the plan that best fits your needs!